Running a nonprofit organization comes with a set of unique challenges, and meeting its finance and accounting needs is no exception. Accurate and efficient accounting practices are crucial for nonprofits to maintain financial transparency, comply with regulations, and make informed decisions. Setting up the finance department structure of your nonprofit — and staffing it with qualified accounting help — can be a daunting task.

Key Takeaways

-

A strong nonprofit finance department isn't just about bookkeeping; it requires a hierarchy that includes transactional staff, compliance experts (CPAs), and strategic leadership.

-

Protect your mission and assets by implementing segregation of duties—ensuring no single person controls money coming in and going out.

-

You don't need a full-time executive to get strategic guidance. Fractional CFOs and outsourced controllers provide high-level expertise that fits a nonprofit's variable budget.

-

The ultimate goal of your finance structure is transparency. Accurate reporting on program outcomes and restricted funds is essential for securing grants and donor trust.

Table of Contents

Finding the right expertise can make all the difference in driving your nonprofit's financial health and achieving your mission. With options ranging from bookkeepers and CPAs to fractional controllers and CFOs, it's essential to understand the roles and responsibilities of each option and determine which will best suit your organization's needs. We're diving into all things nonprofit finance department structure and support today — from understanding the chain of command on the accounting team to some best practices for setting yours up for success:

Financial Management for Nonprofits: 5 Basic Best Practices

Mission-driven work is about more than money, right? But without enough financial resources and the expertise to manage them, there's no way your nonprofit organization could focus on what really matters. In that sense, it's all about the money — making every dollar count while being accountable for where it's going.

Read More: Outsourced Accounting for Nonprofits: Make a Bigger Impact

That's why it's so important to have a clear picture of your organization's financial health and budget, so that stakeholders know what (and when) and how accounting can drive your organization's mission.

-

Develop a Comprehensive Budget

Create a detailed budget that reflects the organization's mission, goals, and planned activities for each month, quarter, and year.

-

Implement Strong Internal Controls in Your Nonprofit Finance Department Structure

Establish robust internal control procedures — segregate duties, audit regularly, and implement approvals — to prevent fraud and safeguard your organization's assets and reputation. For example, practice segregation of duties by ensuring the person who authorizes an expense is not the same person who signs the check.

-

Maintain Transparent and Accurate Financial Records

Implement an accounting system that accurately tracks revenues and expenses, and regularly reconcile bank statements. This will provide a clear and transparent view of the organization's financial health.

-

Track Program Outcomes and Impact

Establish key performance indicators (KPIs) to evaluate the effectiveness of programs and demonstrate the value created by your organization's hard work. This information is essential for accurate, timely reporting to stakeholders and securing funding.

-

Stay Updated on Accounting and Tax Regulations

Nonprofit accounting and tax regulations can be complex and subject to changes. It's important to stay informed about the latest regulations and ensure compliance.

Depending on the size of your team and the health of the accounting talent market, you may or may not have the necessary expertise and resources on hand or even know where to start. You need to start with a firm understanding of basic nonprofit finance department structure to get a clear picture of where you most need help — and how to find it.

Nonprofit Accounting Roles & An Example Hierarchy of Finance Positions

While nonprofit finance policies and procedures may diverge from their for-profit counterparts in key ways, there's plenty of overlap between the two when it comes to positions you could fill on the team to get it all done effectively.

Some roles will likely sound familiar: it's not uncommon for finance departments in nonprofit organizations to be under the purview of a CFO or controller, for instance, with qualified CPAs or staff accountants running everything from accounts payable and billing to payroll and financial reporting.

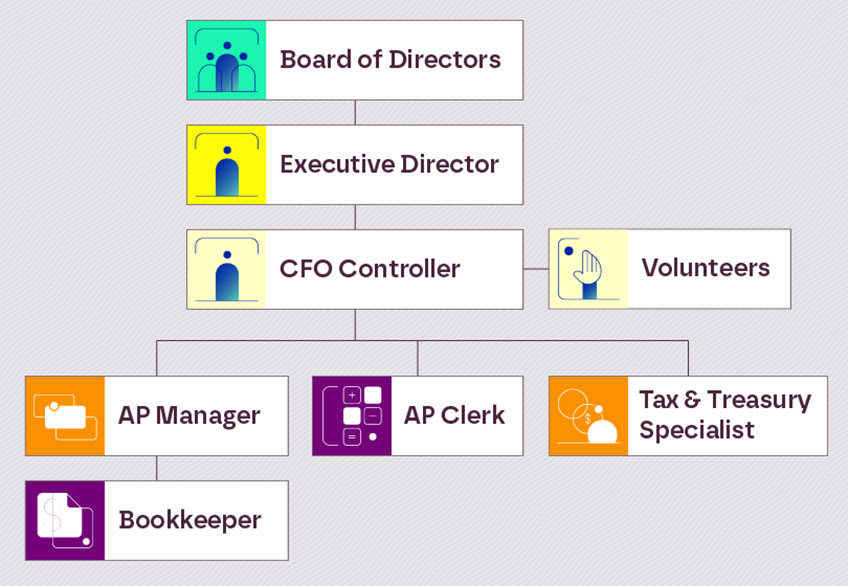

Like for-profit companies, nonprofits answer to a Board of Directors, which will often include a treasury officer seat with the Treasurer working in tandem with finance department leadership and the board. Depending on the size of a nonprofit and the breadth of the work it does, the actual organizational structure or hierarchy of the finance department itself can vary widely, but it, too, will look largely familiar:

Structuring (& Staffing) Your Nonprofit Finance Department

In a perfect world, you'd have endless options for staffing your nonprofit's finance department. You'd have approval for every position as soon as you knew you needed the accounting help and a bottomless pool of talent for filling them. We probably don't have to tell you that we don't live in a perfect world. You're likely operating on a limited and variable budget and tapping into a tough talent pipeline:

Read More: Finance & Accounting Talent Market Outlook Survey Report

For that reason, nonprofit organizations stay lean and agile by focusing on key needs and outside-of-the-box talent sourcing to stay focused on core mission-driven work without sacrificing accountability.

Bookkeepers: The Foundation of Your Nonprofit Finance Department Structure

Bookkeepers play a vital role in maintaining the day-to-day financial records of your nonprofit. They handle tasks such as recording transactions, managing accounts payable and receivable, and reconciling bank statements. Bookkeepers provide accurate financial data that forms the basis for higher-level accounting and decision-making processes. While bookkeepers are typically tasked with work that's less judgment-based, their attention to detail and organizational skills make them valuable contributors to your financial management team.

Read More: The Difference Between Bookkeeping & Accounting — And Why it Matters

Certified Public Accountants (CPAs): Expertise and Compliance

General staff accountants and specialists are often CPAs — they bring a higher level of expertise to nonprofit accounting. They have extensive knowledge of tax regulations, compliance requirements, and financial reporting standards specific to the nonprofit sector and know the ins and outs of generally accepted accounting practices (GAAP). CPAs can assist with tax preparation, audits, financial statement analysis, and provide guidance on complex accounting issues. Their professional qualifications and experience ensure that your nonprofit remains in good standing with regulatory bodies while meeting all reporting obligations. Beyond basic compliance, their oversight ensures your books are always 'audit-ready,' reducing the cost, stress, and time burden of your annual financial review.

Finance Manager / Director: Big Picture Analysis

A finance manager or director oversees staff accountants and bookkeepers in a nonprofit. They often handle broader financial operations, reporting directly to the CFO or controller. Finance managers focus on the day-to-day finance tasks, like budgeting, forecasting, and reporting. They ensure that the reports produced by accountants and bookkeepers are accurate and that the finance function as a whole is running smoothly and according to internal policies and procedures.

Fractional CFOs and Controllers: Strategic Financial Leadership

Fractional Chief Financial Officers (CFOs) and controllers offer a more strategic approach to nonprofit accounting. They bring a comprehensive understanding of financial management and provide valuable insights to drive organizational growth on a contingency or part-time basis. Fractional CFOs can help develop budgets, analyze financial trends, create financial forecasts, and make strategic recommendations to optimize your nonprofit's financial health. While they may not be full-time employees, engaging one allows you to leverage valuable expertise and guidance without going over budget. They build on the work of the finance manager or director, looking at the long-term strategy, capital management, and future growth.

Treasurer: Policy Police

Not all nonprofits will have a treasurer. This type of accounting role is often taken on by a board member with the goal of double-checking financial management policies. They serve as an independent check that staff members are performing finance functions according to the nonprofit’s goals.

Choosing the Right Accounting Help for Your Nonprofit's Finance Department

Once you understand where your organization's needs, talent gaps, and resources intersect, you'll have a better idea of what you need to set your nonprofit's finance department up for success:

-

Assess Your Nonprofit's Needs

Start by evaluating your organization's current and future accounting needs. Consider factors such as the size of your nonprofit and accounting team, the complexity of financial transactions, and the level of financial expertise required. More complex accounting operations will require access to strategic expertise, while nascent organizations may want to start with accounting help that can ensure compliance and close the books accurately and on time.

-

Take Your Budget into Consideration

It all comes back to the budget. Evaluate your financial resources and determine what you can allocate towards accounting services and whether those funds are restricted or not — can you use them for salaries or services, or do you need to look for volunteers with the qualifications you're looking for? Navigating within budgetary constraints can be tough, but cost-effectiveness should never come at the expense of competence and consistency.

-

Seek Recommendations and References

Reach out to other nonprofit leaders or industry professionals for recommendations and references. Their firsthand experiences can provide valuable insights into the accounting professionals they have worked with. Consider researching online reviews and testimonials to gather further information about potential accounting partners and decide how you'll determine which candidates or companies will get on your shortlist.

-

Engage in Interviews and Assess Expertise

Once you have identified potential accounting professionals or firms, conduct interviews to assess their expertise and compatibility with your nonprofit's goals. Ask about their experience working with nonprofits, their understanding of nonprofit accounting regulations, and the level of support they can provide.

Download the Tool: Virtual Accounting Vendor Comparison Spreadsheet

-

Consider When Outsourcing Fits Your Nonprofit's Finance Department Structure

Outsourced accounting services can be a valuable solution for nonprofits seeking comprehensive accounting support — or a single resource like a fractional CFO or full-time controller. Partnering with an outsourcing provider can open up additional sourcing possibilities, and the right partner will offer scalability, cost-effectiveness, and access to a breadth of accounting knowledge.

Navigating the realm of nonprofit accounting can be overwhelming, but understanding the different accounting roles and their contributions is essential for making informed decisions. Whether you require foundational bookkeeping, compliance expertise from CPAs, or strategic financial leadership from fractional CFOs, there is a solution that aligns with your organization's unique needs.

Creating the Foundation for a Strong Finance Leadership Team - With the Right Nonprofit Structure

When it's time to build a nonprofit finance department structure that meets your needs and achieves your goals, you have options. But when it comes to the complexities of nonprofit accounting and the need for cost-effective solutions, outsourcing accounting services can be a game-changer.

Cost-effective and flexible, outsourcing can enable nonprofit finance sustainability and access to much-needed expertise without interrupting your important, mission-driven work. Personiv is a trusted partner in outsourced accounting with decades of experience providing custom virtual accounting solutions. Whether you need a single bookkeeper, a team of certified specialists or a seasoned financial leader that works just for you, you'll find a solution that meets your needs when you partner with us — at a price that works for you.

When you're ready to streamline your accounting processes, gain access to a team of skilled professionals and focus more resources on advancing your nonprofit's mission, talk to us.

Frequently Asked Questions